Loan-to-purchase employee share schemes: What employees need to know

Understanding the finer details of a loan-to-purchase scheme can open the door to partial ownership in a company and potentially help you build long-term wealth.

Loan-to-purchase schemes, and how they’re structured

A loan-to-purchase employee share scheme is typically offered by companies to key staff, such as highly skilled employees.

It provides an accessible way for employees to purchase shares upfront in the company at market value via a loan. This loan is usually provided by the company or a financial institution it has partnered with, and it’s not uncommon to be offered at a low or zero interest rate.

If you sign up for a loan-to-purchase scheme, you’ll typically repay the loan via your salary and/or any company dividends you earn. Depending on the structure of your loan, you may also be able to contribute cash bonuses you earn from the company towards your loan repayment.

Benefits and risks of a loan-to-purchase scheme

Employee share schemes such as loan-to-purchase schemes come with benefits beyond the opportunity to build long-term wealth:

you can become a partial owner of the company without a large upfront financial investment, like with property

there’s potential future capital gains and dividend distributions

you get a sense of ownership in the business.

However, there can be risks associated with a loan-to-purchase scheme:

failure to repay the loan could have a financial impact on you

the value of your shares may decrease instead of increase

potential tax implications if the shares are offered at a lower price (i.e. at a discount) than the fair market value.

If you receive shares at a discount, income tax may apply for the difference between the price the shares are purchased for and the fair market value at the time of purchase.

Leaving the company

Finally, it's important to consider the impact that leaving the company before the loan is repaid may have on your shares. If you leave the company before the loan is repaid:

the company may have the ability to ‘claw back’ those shares, and

they may also have the right to purchase back any shares (usually at fair market value) you have paid down while you were working for the company.

Before signing any agreement, we recommend that you consult with an independent financial advisor who can take you through the legal agreement in more detail.

Your responsibilities and rights in a loan-to-purchase agreement

It's important to be aware of your responsibilities and rights before entering into a loan-to-purchase scheme agreement.

In addition to your responsibility to repay the loan according to the loan agreement, you should also be aware of the following.

Is it a full recourse loan?

A recourse loan holds the borrower (the employee participant) personally liable for the loan, which is taken out to purchase a stake in the company.

Depending on whether the loan is a full recourse or not will also influence whether the company has a right to pursue loan repayment even if the value of shares decreases (i.e. the employee has a loan that is more than what the shares are worth).

Do you get voting rights?

Depending on the nature of the loan-to-purchase agreement you enter into, you may have the right to vote at shareholder meetings. However, in most cases, loan-to-purchase scheme agreements do not include voting rights.

Are dividends applied to the loan?

Check to see whether any dividends received from the company will be automatically applied to the loan, paid out in cash, or split between the two (often referred to as a ‘dividend split’).

Will shares be held in a trust?

When shares are held within a trust on your behalf, you’re not technically the shareholder. Instead, you hold a ‘beneficial interest’ in a certain number of shares.

This means that personal information such as name, address, and the number of shares that you have a beneficial interest in remains private.

In addition, it may mean that the trustee has control of voting and rights relating to the shares.

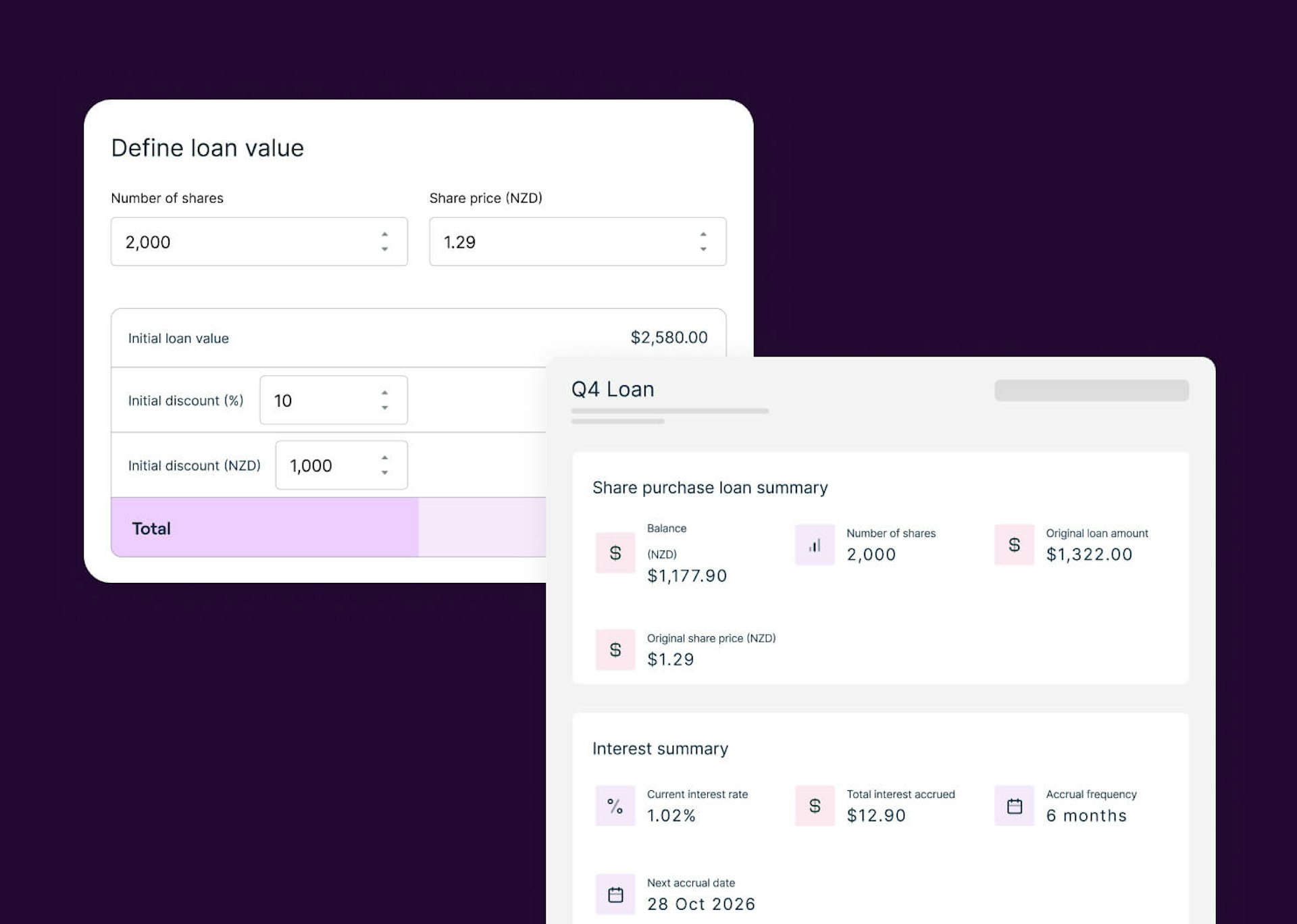

Access to your loan-to-purchase agreement

If your employer is with Sharesies Private, you can track your loan-to-purchase employee share agreement in real time.

Here you’ll find all the loan-to-purchase documents and details from your agreement, alongside any other privately held shareholdings you may have.

Key terms

At first glance, a loan-to-purchase agreement can seem confusing and packed with unfamiliar jargon. Below, we’ve outlined some of the key terms you may come across:

Accrual—the accumulation (or increase) of interest over time.

Dividend distributions—the payment of a company’s earnings to eligible shareholders.

Employee ownership—an arrangement in which an employee can own shares in the company they work for, or the right to the value of shares in the company.

Fair market value (FMV)—an asset's estimated value if it were sold in the current market.

Loan —the loan of money to an employee by the company or an associated financial institution.

Loan-to-purchase agreement—the agreement between an employee and a company for the employee to purchase shares upfront, via a loan, in the company at market value.

Interest—the price paid to borrow money or the return earned on an investment.

Offer—the contract made to an employee through an employee share scheme offer letter.

Recurring payments—a company automatically deducts an employee’s loan repayment on a regularly scheduled basis.

Repayments—the act of paying back the loan to the company.

Shareholding—the shares in a company that a shareholder owns.

Sign up for a guided tour, and see how Sharesies can help your company.

Now for the legal bit

This article is for informational purposes only and contains general information only. Sharesies is not, by means of this information, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This information is not intended as a recommendation, offer or solicitation for the purchase or sale of any options or shares.

Join over 930,000 people