Equity management, and why it’s important for companies

Curious about equity management? Learn what equity is, why managing it matters, and how software can simplify investor engagement and compliance.

What is equity in a company?

The equity in a company often refers to the ownership, which can be expressed as the amount of shareholding or number of shares. Shareholders' equity shows how much the owners of a company have invested in the business—either by investing money in it, or by retaining earnings over time.

A company's shareholder equity is found on the balance sheet of the company’s financial records and is calculated by subtracting total liabilities from total assets. If equity is positive, the company has enough assets to cover its liabilities. If negative, the company's liabilities exceed its assets.

What is equity management and who is it for?

Equity management can be defined as the process of creating and maintaining details on the ownership of a company. For start-ups and small companies this may seem simple when there is only one or two owners, but the information and maintenance can get complex once a company raises capital and takes on more investors or shareholders.

This introduces requirements such as collecting information on new investors, managing changes in shareholdings, communicating and engaging with stakeholders, and keeping records and documents from board and meetings.

In addition, there are local regulatory requirements for companies which require detailed tracking and reporting of equity information. For example, a company share register is a legal requirement for Australian and New Zealand companies, and this must be maintained as an official record of all shares issued by a company and the shareholders or members who have received these shares.

How do you manage equity details for a company?

The person or people in a company responsible for equity management have several areas to cover.

In large companies there may be a dedicated Company Secretary or a similar equity manager role. However, for small-to-medium-sized companies, it’s often the CEO, CFO, or someone in the Finance or HR functions responsible for these activities.

Share register management

The following details are typically tracked and updated in a share register—this can get more complicated as a company raises capital and issues more shares:

all shares issued by the company

all shareholder (or member) details including name and addresses

the dates and information of any repurchase or redemption of shares for each shareholder

any transfer of shares by each shareholder.

Information about the class or classes of shares also needs to be kept along with any restrictions or limitations on the shares.

Additionally, if the company has an employee share ownership plan (ESOP), then the details for this including all participating staff information needs to be maintained along with any options and other securities which may convert into shares in the company.

Stakeholder management and engagement

Regularly communicating with stakeholders on the latest company information is critical for ongoing engagement and support.

With more knowledge about your company and engagement, existing investors are more likely to keep investing.

If the company has an ESOP, then regular communications to staff are important for engagement and motivation to help develop a sense of ownership in the business.

Updating regulatory bodies

If shareholding or shareholder details change, then a company is required to maintain their share register and then advise their regulatory body of the changes.

Australian proprietary companies need to advise the Australian Securities & Investments Commission (ASIC) on many share register changes including changes affecting the top 20 members in each class of share.

New Zealand companies need to advise the on key details including company name or address changes, updates to shareholders' personal details, and shareholding changes.

What happens if equity is not managed correctly?

Outdated equity details can cause major problems for companies when undertaking key events such as shareholder communications and voting, raising capital, or distributing a dividend.

There are also wider implications as regulatory bodies can bring a range of penalties and actions against companies who do not meet their share register requirements.

For example, in Australia, ASIC can charge hefty late fees if a company has not updated details within the correct timeframes, and they may de-register a company if it has outstanding fees and penalties.

New Zealand companies and directors can face prosecution for not meeting their obligations and a significant breach can carry fines up to $200,000 NZD or imprisonment for directors.

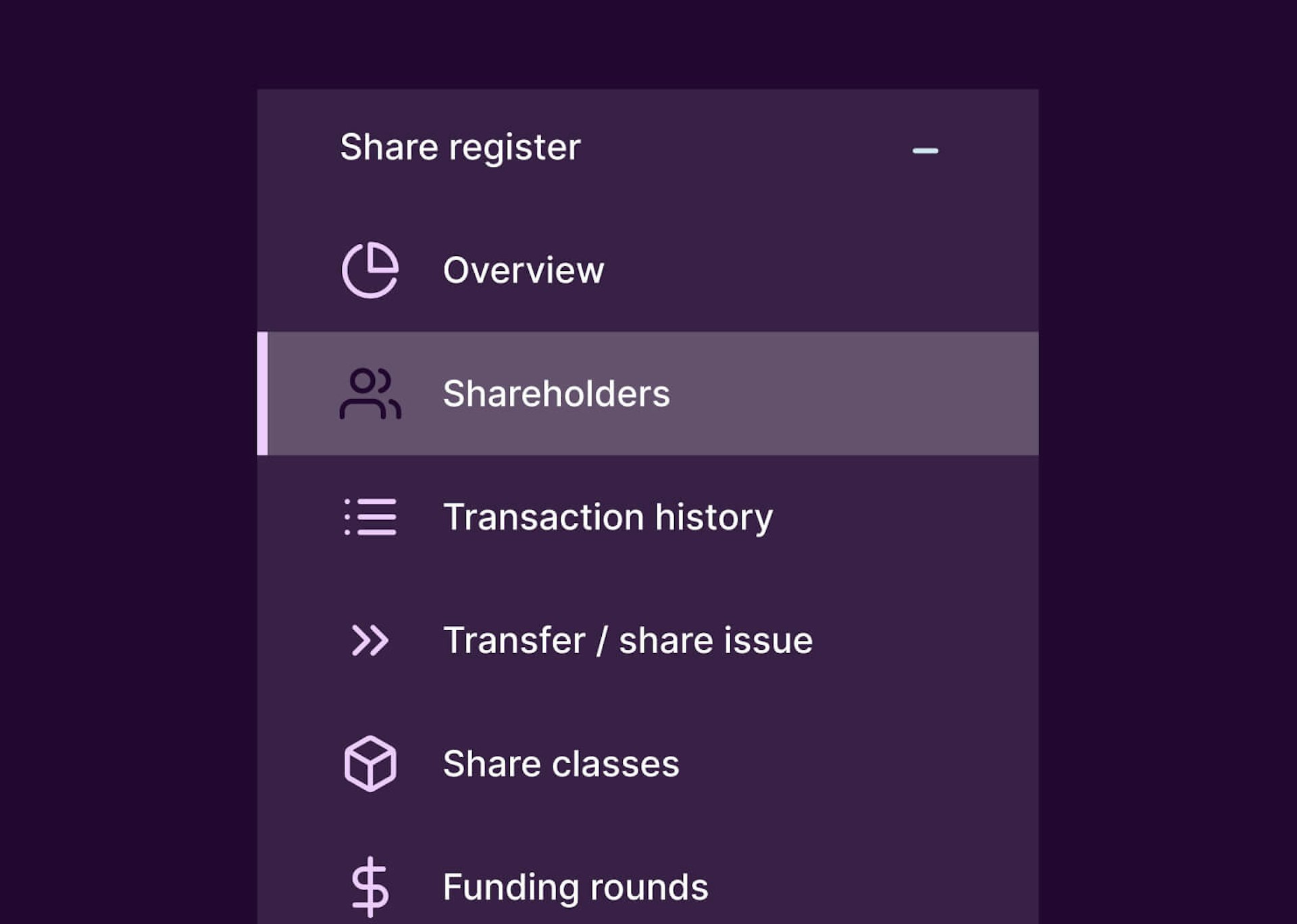

What is equity management software?

To avoid incorrect or outdated information, companies can use online equity management software to organise and track details on their stakeholders and the equity they hold.

Equity management software for private companies includes features such as:

share registry management

document storage for stakeholder access

stakeholder communications

ESOP set-up and management

dividend management.

An online equity management software platform like Sharesies Private offers an easy way to ensure equity management requirements are met, while also creating a single source of truth for the company and its stakeholders.

Why use equity management software?

There are several reasons why companies of all sizes should use online equity management software.

Compared to using a spreadsheet for share registers and equity management, online software can reduce manual share register tracking for the company, and reduce errors compared to using spreadsheets. It can assist with compliance by making it easier to update the relevant regulatory bodies, particularly if there is an integration between the software and the regulator’s registry.

Importantly, online equity management software can help to streamline stakeholder management and improve valuable engagement. Investors receive increased visibility by being able to log in to access their shareholding details and any relevant documents.

Any communications to investors can also be managed through the software – and because all the shareholder names and emails are up to date, this becomes a seamless process. Consequently, shareholders feel engaged and up to date with the direction of the company.

Sign up for a guided tour, and see how Sharesies can help your company.

Now for the legal bit

This article is for informational purposes only and contains general information only. Sharesies is not, by means of this information, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This information is not intended as a recommendation, offer or solicitation for the purchase or sale of any options or shares.

Join over 930,000 people