How ETFs can fit in your portfolio

Brendan Doggett (Sharesies’ AU Country Manager) and Cameron Gleeson (Betashares’ Senior Investment Strategist) chat about the power of exchange-traded funds (ETFs).

Brendan: So today, we're going to be talking about exchange-traded funds, also known as ETFs. For those of you who don't know, an ETF is made up of a group of companies, rather than just one company, and trades on a stock exchange like the ASX. They've been around since the early 90s, and they’re a very popular way to invest, with over 75% of Sharesies investors having an ETF in their portfolio. So Cameron, over to you, tell us a bit about yourself and Betashares.

Cameron: Hi Brendan, thanks very much for having us. So myself, so my name is Cameron Gleeson. I'm Senior Investment Strategist at Betashares. I guess I first got interested in markets back when I was a kid. In the late 80s, there was a bit of a bull market, shall we say. And I grew up in Perth. And so there was a lot of mining stocks running hot at the time. But I ended up studying engineering before realising that, you know, my true passion was markets. Got a job over in Sydney. You know, it's sort of early 2000s, just before the GFC on a trading floor, and have been in markets and then eventually funds management.

I joined Betashares a little over three years ago now. Betashares is an Australian owned and operated exchange-traded fund provider. And we've really carved out a niche for ourselves, managing the wealth of over 800,000 Australians, we have the widest range of exchange-traded funds available on the ASX. And I believe we're well supported by Sharesies. So we appreciate everyone who's listening to this recording, appreciate all your support. We put that down to being Australian focused, we have you know, an appreciation as to what the Australian and also New Zealand investors are looking for, within building investment portfolios, and it's just really about providing access to the tools that people need to build a portfolio.

Brendan: Yeah, that’s right. There’s 84 Betashares ETFs on the Sharesies platform, and many of those are in the top 100. So we can go through a couple of those a bit later. I think there's some super interesting ETFs. How have ETFs evolved over that time, what have you seen?

Cameron: Yeah, so when I started working in markets, I wasn't working in exchange-traded funds. And there was, I think there was two exchange-traded funds available in Australia in about the year 2003. And they weren't that popular. Exchange-traded funds took a little while to get going in this country. It wasn't really until around about 2010 that people started paying attention.

The first iteration or if you'd like the first version of exchange-traded funds, were what we described as a market capitalisation weighted approach to investing in equity markets. So for example, if you wanted broad exposure to the largest 200 Australian shares, and you wanted to do that, in a way where you hold each company in proportion with its overall size, you might invest in exchange-traded funds. And obviously, the overall objective is to get that broad market exposure but at a very low cost.

So they were the first generation ETFs. Beyond that, we then moved into sector based ETFs. So if you want an exposure just to Australian miners, or global banks or any sector. We saw that fixed income and cash ETFs started a few years after that, and then followed by thematic ETFs and smart beta ETFs, which are alternative ways of weighting a basket of stocks. So the environment in terms of ETFs is quite rich, the different choices, the different styles of investing that you can adopt through an ETF, there's a lot to choose from there. And that's only a good thing for investors.

Brendan: Could you explain the concept of smart beta a little bit more?

Cameron: Yeah, so smart beta. Bit of a catchy label. I talked before about how the first generation of ETFs had a market capitalisation weighting approach. So if you think of the total dollars invested in an ETF, if you'd invested $100 in an ETF. If the total market weight of the top 200 companies in Australia had, for example, a 10% weighting to BHP, your share of that overall ETF, $10 of your overall investment will be allocated towards BHP. And so you know, as I said, market capitalisation, so weighted based on the size of companies.

Smart beta ETFs, or sometimes they're called factor ETFs, are an alternative rules based approach to weighting. So that might be something as simple as an equally weighted approach. For example, QUS is our Betashares S&P 500 equal weight ETF, which basically gives you 0.2% in each of the top 500 companies in the US. And then we have different types of smart beta. So for example, you might have a quality, smart beta ETF, which invests in quality companies, or a value oriented, smart beta ETF.

And these are all rules based approaches to try to get a particular investment exposure that you want. But because they're rules based and there isn't an active manager, they tend to be much lower cost than an active manager. So that's been very interesting for a lot of investors that are looking to lower costs, and get a particular profile in a fund or investment exposure thereafter.

Brendan: Thanks Cameron, that gives us a good background on how ETFs have evolved and what's on offer. I think if we look back at how the markets have been probably over the last 18 months or so, it's been a bit of a roller coaster, a bit volatile. So really keen to get your take on what you've seen in the market over the last 18 months.

Cameron: Yes, it has been very interesting, hasn't it. So if we sort of cast our mind back to the start of 2022, we know that central banks started hiking interest rates in response to inflation, which looked increasingly embedded. And then we had, of course, the threat of a recession, both in Australia but also the chance of a recession in the States as a result of tighter monetary policy.

Now, interestingly, we really have that same economic backdrop still playing out even this year, despite the fact that that's been going on 18 months. But if we look at the performance of asset classes, their performance this year, various asset classes, we're talking about Australian equities, global equities, we're talking about fixed income, or even commodities like gold or oil. We've seen very different, you know, levels of return this year versus last year.

So for example, last year, Australian equities outperformed global equities. And that kind of made sense, because we saw that commodity prices were quite strong last year. And Australian equities on the whole have a higher tilt to commodities through our large miners. We saw last year that fixed rate bonds or bond funds sold off quite heavily. Whereas this year, we've seen that global equities has outperformed Australian equities and bond funds have done pretty well. So there's been somewhat of a reverse as to what's happened last year.

And of course, one big thing that people are talking about in markets is the impact of artificial intelligence. And what that means to some of the very large US tech firms, both in terms of their future business prospects, but obviously, you know, what we have seen in markets is their share prices have shot up. So it's a very interesting dynamic in market, there's a lot of concentration to be aware of there. And there's ways to think about building a portfolio that you know, where we need to sort of think about pulling different exposures from across the investment landscape to ensure that we're, you know, really reducing some of those risks.

Brendan: Which is a great segue into the next question. When the markets are like this, and there's technological change, and some companies are going to be well positioned, and some geographies. It's a great chance to kind of talk about how ETFs can help you when the markets are volatile. So question for you, how can ETFs help when the markets are so volatile?

Cameron: There's probably four sort of key things to think about. I mean, the first is that point about access. So bringing a real ease to be able to access exposures, whether it be global equities, different types of fixed income exposures, you know, through a single trade on the ASX. So that access point is really key.

Secondly, and when we think about building a portfolio and compounding long term wealth over the long run, we're looking for low cost diversified investing, that's really key. The third point, I'd say around ETFs, is the transparency. So ETFs, which track indices, will publish the full list of holdings every day, so you can see exactly what's in your fund and understand where you may have overlaps between your current investment portfolio, and a new fund that you're looking to add.

And then finally, just the ease of ability to transact an ETF means that you can sell one ETF and on the same day, buy another one if you're looking to switch from one exposure to another, so that will be key characteristics which I would be thinking about if I'm looking to build diversification, which really is the only free lunch in investing, build a diversified portfolio.

Brendan: And then if you think about your wider portfolio, so the usual type of investor, the typical investor on the Sharesies platform has three ETFs, and maybe a handful of companies, names that they know, companies that they're interested in investing in. How do you think about making up your portfolio and using ETFs within that kind of wider portfolio?

Cameron: So the way that I think about investing is there's, you know, real mental mind games, you know, behavioural finance is a big part of, of our investment outcomes. And when I think about building a portfolio, I think one approach, which has a lot of merit, is what's called a core and satellite approach.

Now, you know, we know that people are emotional, and that when markets move, it changes our behaviour. One way to combat this is to ensure that at least part of our portfolio, which we'll call the core, is very much diversified, is relatively resilient in market drawdowns, and is essentially keeping up with overall market performance. And we do that by building a portfolio out of different asset classes, such that the overall expected risk or volatility or the bumps and shakes of our portfolio are at a level we can tolerate.

So if I'm quite risk averse, I'll probably add more cash and more bonds in my portfolio. If you Brendan, are quite, you know, risk tolerant, you might choose to build your portfolio purely out of equities. So I may choose, for example, one global equity ETF, one Australian equity ETF, and a fixed income ETF, whereas you might choose, in fact, just to use the Australian equity ETF and the global equity ETF, if that was your level of risk tolerance. The ability to to build something which is in line with what you can handle when the markets are falling means you're more likely to continue to invest. Because we know that's the secret to building long term wealth, is to continue on your plan, continue investing. That's the secret of the core, is building that sort of long term wealth through that continued investment.

And then you've got the satellite. And the way I think about that satellite is that, I won't say it's the play money, but it's the part of your portfolio where you chase out performance, where you might make tactical bets because you believe that a particular theme or a particular company's going to outperform. So we think about driving diversification, keeping the low costs through the core. And then you've got your satellite allocations to those, in the example you used, those three stocks that they might hold, they might particularly like BHP, you know, CSL and, and CBA. And if they believe that they're going to outperform, they hold those as a satellite. That's an approach which is used by a lot of individuals and I think holds a lot of merit.

Brendan: So on the Sharesies platform, a lot of our investors are really interested in investing money with companies which have ESG principles at heart. So that's environmental, social, and governance principles. And I know Betashares has a couple of very popular ETFs in that space, and they're in the top 10 of the holdings held on Sharesies. Just wondering if you could tell us a bit more about how ESG principles are put into operation when you're pulling together an ETF focusing on those?

Cameron: The one thing that we have found is that, you know, every individual who's interested in investing in line with their values has a different set of values. There might be, you know, a lot of similarities, we find, particularly with regard to the E or the environmental considerations, but there are always differences.

The approach that we adopted at Betashares was to provide a range of what we call ethical and responsible investing funds. And these consist of three really core funds, one being ETHI, which is our global sustainability leaders. FAIR is our Australian sustainability leaders. And then we've got GBND, which is our sustainable bond ETF. Now, these are designed to be core funds. But for those that have particular ESG criteria they want to meet. So they're diversified across their three asset classes. But we apply really stringent screening across a very broad range of ESG issues, both positive and negative. And we also do a lot of stakeholder engagement or we engage with the companies that we invest within these funds to ensure that those companies are acting in alignment with the philosophy of these funds.

So they're particularly designed to be called what we call dark green in screening so that the broadest range of investors is going to be comfortable with what's actually held in the fund. So they've been very popular, particularly ETHI, the global sustainability leaders. I know that's been well supported on Sharesies, so we appreciate the support. But they're the core funds.

Beyond that, within that ethical and responsible investing suite, we also have some thematically or sustainably themed thematic funds. And a good example of that would be earth or ERTH, which is our Betashares climate innovators ETF. Now this is a portfolio which is specifically made up of companies who have products and services that allow their customers, whether they're customers are consumers or other companies, to reduce their carbon footprint. So we think about, you know, all of the ways that a company, for example, creates emissions, it may be through the power it buys, it may be through the vehicles that they drive, or through their industrial processes. There are lots of really good companies out there. And this ETF ERTH holds 100 global companies that have solutions to allow them to lower their carbon footprint. That's what I call a thematic ETF. It's sustainably themed. But it's what you might hold as a satellite as opposed to ETHI and GBND, which are more of those core diversified funds.

Brendan: When we talk about thematics, you mentioned that there are lots of really interesting thematic ETFs out there. So just kind of interested in how do you even go about deciding what thematics to have? What are the next interesting ones coming on? And you know, have you seen some out there which are very interesting?

Cameron: So when we look at an investment theme at Betashares, we're really looking for three key criteria. One is because we're an ETF provider, there must be enough companies that are liquid that are traded on exchanges that are adequately exposed to the theme. So there's such a thing as a theme being too embryonic or too early in its development stage, because we want to ensure that we can provide diversified exposure to a group of those companies.

The second thing we need to ensure that the theme isn't a fad. You know, there were lots of these sort of fads around COVID, like a stay at home thematic or something like that, which sort of reverted a couple of years later, when people threw out their Peloton and started getting on road bikes again.

And then the third element really is to ensure that, you know, in our view, that we have high conviction that the companies either have competitive advantages, or as a some sort of moat, or sustainable competitive advantage, which means that they can either retain a high level of profitability or drive to profitability in the future.

So you know, the key to investing in themes is the long term growth runway from increasing adoption of a new product or service. It's no good participating if the companies themselves have no competitive advantage, and will be swamped by you know, incumbents or other larger companies whilst that theme reaches exit velocity. So they're the three criteria we look for. And in an ETF, we want to provide diversified exposure to that group of companies.

So a really good example of that would be say, for example, global cybersecurity. We have an ETF, which the ticker code is HACK, that ETF has been around for might be close to seven years now. It's had very strong performance over all types of market cycles. And it's made up of a group of companies, who are the global leaders in cyber security. We're not taking individual bets on companies, because we know that in emerging themes, there's actually, you know, a relatively high failure rate of companies. It's difficult to tell who will be the winners and the leaders. So we think that you're better off holding the basket or the thematic in entirety, and letting market forces take care of that and benefiting from holding more of the winners. Um, so that's been our approach. And that's how we think of thematic investing.

Brendan: And that's one of the great things about ETFs and diversification, that there are professional fund managers looking at it, making sure that the quality companies are in there, and there's liquidity in the market. On the diversification point. Can you ever have too much diversification?

Cameron: Look, I mean, I see examples of too much diversification. And one example, which I'm not so sure is relevant for Sharesies investors, but is where we often see financial advisors will blend you know, four or five actively managed funds in one asset class, which have a higher fee load and their active bets often cancel each other out. The concept is sometimes referred to as “diworsification”. But if you can get really low cost, you know, diversified exposure across the major asset classes. I think that's an excellent place to start.

So for example, if we look at what are known as diversified ETFs, which are an all in one solution for your portfolio. We have a fund, which is our Betashares diversified all growth ETF, which is essentially a blend of Australian equities and global equities. And you can buy that on the ASX in one trade, the underlying ETF holds 8000 companies. So that's a great level of diversification. And I think that's an excellent place to start if you're an investor having that breadth in one trade, and you can obviously, you know, therefore, by exposure to those 8000 companies with very little initial capital. So that's my viewpoint.

Brendan: So where are people starting to invest now in your ETFs and showing what kind of themes that people are interested in?

Cameron: If we think about core portfolio holdings, a lot of money has entered portfolios through fixed income and cash ETFs. People have been somewhat defensively positioned throughout this year. But if we think about, like those satellite or thematic ETFs that people would use to drive out performance.

Two funds that have done particularly well. Our NDQ, our NASDAQ 100 ETF, RBTZ is our global robotics and artificial intelligence ETF that has done particularly well given how AI has really sort of, you know, outperformed the broader market as a theme. And then beyond that, you know, if we look at areas in energy transition, our global uranium ETF, which is URNM has captured pretty significant inflows as well as XMET, which is our energy transition metals ETF which has a range of global producers of, of eight different commodities that are required for that energy transition from lithium through to cobalt, nickel and alike.

So, there's sort of two key trends around digitalisation and AI and then also the energy transition within satellites. That's where people have been looking to drive out performance. Given there’s somewhat circumspect about broad equity market performance with you know, we're still in a tightening cycle and concerns of the overall economy.

Brendan: I do love the ticker codes, I think when you've got four letters to deal with and there’s some great ticker codes out there with some great thematic ETFs. So, first prize to the marketing team. Thank you everyone for listening in and thank you, Cameron and Betashares for coming to us today.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

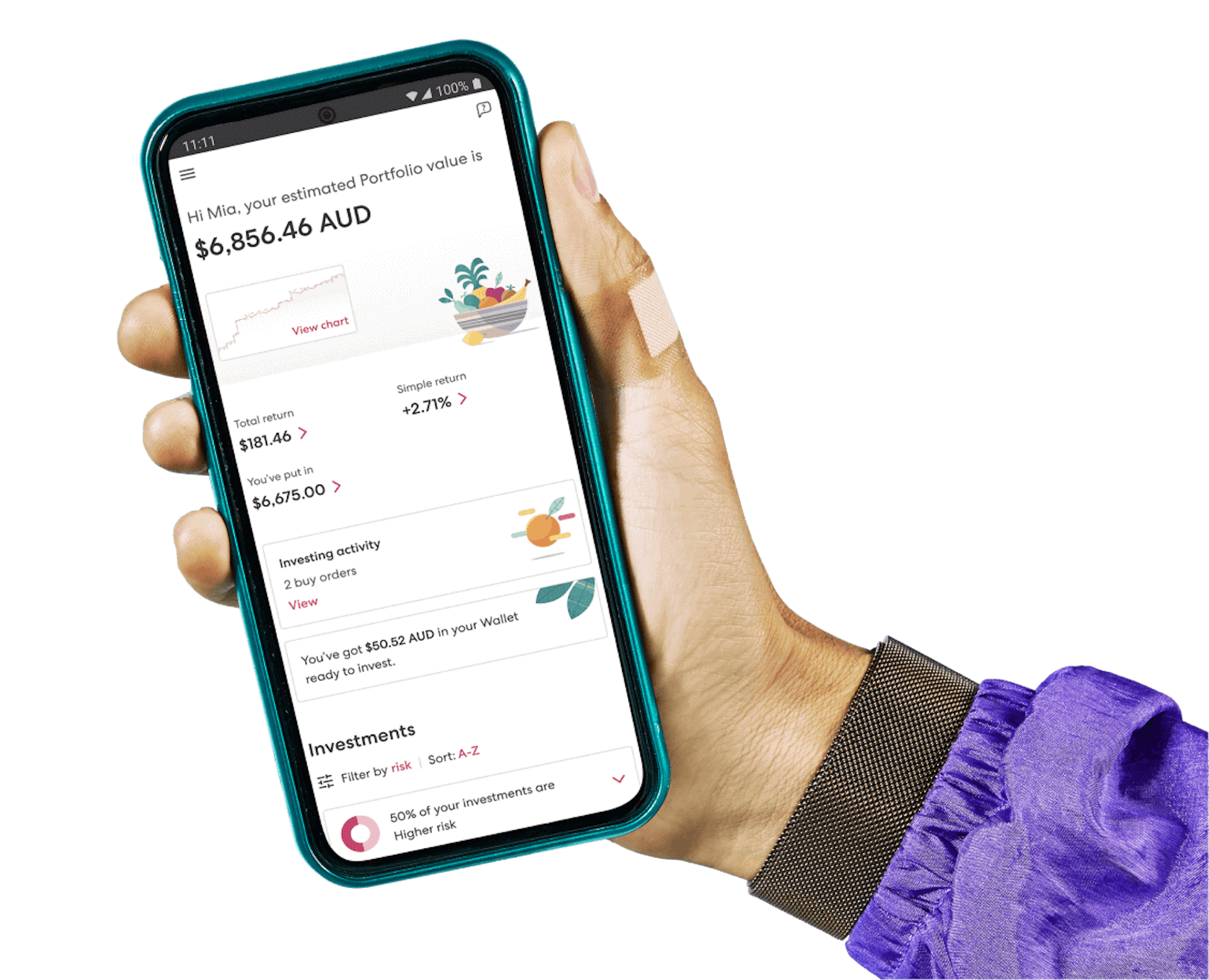

Join over 600,000 investors