Webinar recap: how to do due diligence

Replay our webinar about doing due diligence on investments, featuring Brendan (Sharesies’ AU Country Manager) and John Caulfield (VanEck’s Director of Intermediaries and Institutions).

As an investor, you may have heard the term ‘due diligence’. This is the research you do to decide whether you’re going to put money into an investment or not—it’s basically a fancy word for doing your homework.

For our March webinar, Brendan (Sharesies’ AU Country Manager) was joined by John Caulfield (VanEck’s Director of Intermediaries and Institutions) to chat about how investors might do due diligence for companies and funds. If you missed it, check out the summary below!

Due diligence on companies

One place to start with due diligence on companies is to ask questions about what the company’s trying to achieve and how it’s planning to get there. For example:

What does the company do?

Who are the people involved (CEO, Board of Directors, etc.)?

What does the industry look like (market size, competitors, etc.)?

What’s the company’s strategy (and its track record for delivering on that strategy)?

What’s the company’s impact on the world?

Dig into annual reports

One place to find information to help answer these questions is a company’s annual report. A few examples of what you might find in an annual report include:

Progress and updates on the company’s strategy

Reports from the board and management

Performance—including against ESG (environmental, social, governance) measures

You can also find information on the company’s financials. For example:

Income statements which show a breakdown of the company’s revenue and expenses

What did the company spend their money on?

Is the company making a profit? Are the profits growing or declining?

Or are they choosing to reinvest their money into growth, over making a profit?

What’s driving this performance?

Balance sheets which show the company’s assets and debts, and total equity (assets minus debt)

What makes up the company’s assets?

How much debt does the company have compared to its assets?

How much cash does the company have on hand versus the rate at which it's using it?

Cash flow statements which show how much the company’s cash balance has changed during a period and what makes up its operating cash flow (the day-to-day).

You can also find this information in the ‘investor centre’ or ‘investor relations’ section of a company’s website—or even through a simple Google search! Look at the latest news about the company, press releases, and announcements on the stock exchange’s website.

It’s about gathering information so you can start to form an idea of where the company’s heading in future, and the progress they are or aren’t making.

Due diligence on funds

Due diligence on companies is one thing, but there are also exchange-traded funds (ETFs). John shared some of the benefits of investing in ETFs over companies when it comes to due diligence.

Some of the questions you might ask when you’re doing due diligence for ETFs include:

What’s the fund’s name, investment objective, and description?

Who manages the fund (and what’s their track record)?

How actively is the fund being managed?

What will your money be invested in?

How diversified is it?

How does it align with your values?

How has the fund performed in the past?

Has it previously done what it set out to do?

What are the risks of the fund?

Does the fund have a minimum recommended investment timeframe?

What fees do they charge?

While this isn’t an exhaustive list, it’s a start! It’s about trying to understand what you’re putting your money into, and whether or not that aligns with your situation and goals. Investors can typically find this info on a fund manager’s website (along with regular fund updates) or in the specific fund’s disclosure document or prospectus.

Wrapping up

A big thanks to John at VanEck for joining us! If you want to learn more about due diligence, make sure to check out our Learn article and explore VanEck’s Learning Hub.

Got a topic you’re keen for us to cover in our next webinar? Get in touch via Facebook, Instagram, or TikTok.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

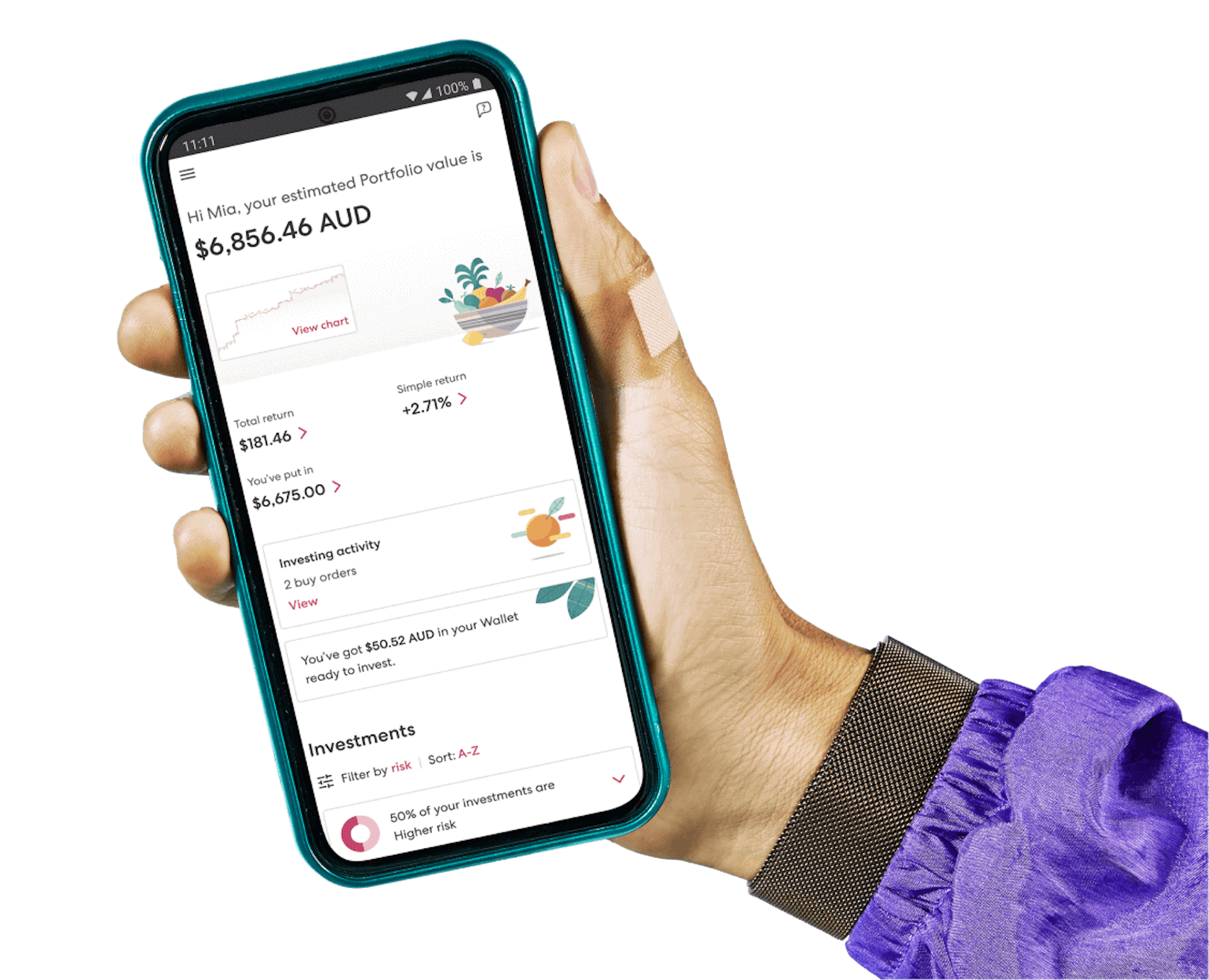

Join over 600,000 investors