How to navigate the investing landscape in 2022

We recently held our first Share Club event in Melbourne, where we chatted about all things money, investing, and market news.

Alongside Victoria Devine, award-winning financial adviser and best-selling author, James Kirby, leading Australian financial journalist, commentator, and broadcaster; and our very own Brendan Doggett, Country Manager of Sharesies Australia—guests enjoyed an evening of delicious Sharesies snacks and investing insights.

The topic on everyone’s mind was the current market. With ongoing volatility globally, Brendan opened with a welcome dose of perspective, “When you look back at the market, you can see this has happened before. Markets go boom and bust, and that’s part of investing. It doesn’t mean now’s not the time to invest. We’ll discuss tactics to keep you feeling confident and close to your investing strategy.”

Taking on the downturn

The general theme of the discussion centred on both looking to (and learning from) the past. It can’t be overlooked that we’ve gone through four interest rate hikes this year already— when we were told there’d be none until 2024. No one can predict the future with absolute certainty. The markets could go up or down. It can be tempting to see this uncertainty and worry; however, experts often caution us to view current events in a broader context.

Victoria regularly championed this idea on the night, sharing her mantra: “when in doubt, zoom out.” If you take a broader time range like 1992-2022, market falls seem less eventful than when first experienced. And following longer-term trends can be useful to help you plan rather than stall your investing strategy or miss out altogether. As James put it, “The first rule of investing is not to lose sight, and the second is how you respond to it.”

There have always been bull and bear markets. It can sound scary but don’t feel discouraged. As Brendan noted, “600,000 investors trust their money with Sharesies, and they all started somewhere. Time in the market beats timing the market.”

Dancing with debt

An audience question took the conversation in an interesting— and hotly discussed— direction: debt, including tax-deductible and consumer debt. The panel discussed the very common scenario of investing while you have debt. Victoria commented, “We’re happy to spend money on things that bring us happiness and align with our values, and if investing aligns with your values, it’s okay to invest when in debt.”

However, there are also benefits to paying off debt first. In fact, paying off debt can be an investment in itself. Another gem from Victoria: “Say your current interest rate is 7.99%, and the market isn’t returning that amount. Once you pay down the balance of that debt, you’re already saving the interest.” It’s one way to make a small money win in the current market.

Putting that saving into investing, even if it’s a small amount, can help boost your financial literacy while prioritising your debt.

Getting personal on money matters

You might assume that when it comes to money, our panellists always had it “all figured out”, but that couldn’t be further from the truth. Take Victoria, “I felt the need to fit in, buy the most expensive clothing, shoes, and bags—but no one cared, and I went into debt for that.” Brendan said, “I wish I learnt about the power of compounding returns a lot sooner because if I’d invested just $1 a day until I was 18, I could be a millionaire by now!”

If nothing else, we host our Share Club events not only to share knowledge but also to share personal experiences. No one is born an expert on money. But that doesn’t mean you can’t start learning. You’ll be in some pretty great company (if we say so ourselves). 😉

ETFs and final thoughts

Another theme of the evening was diversification; more specifically, ways to diversify your portfolio in an ethical way. Recent global events have caused many people to rethink where their money is going (or what it could be funding), so the topic has never been more timely. James flagged the complications of investing in green-focused options, as there is “no standardised sustainable benchmark.” However, Victoria added, “There are so many ETFs (exchange-traded funds) out there that align with people's values. Niche options that’ll help you whittle down what your drivers are when it comes to investing. If you know how long you want to invest, how much, and have some involvement, you can find an option that suits you.”

While uncertainty was no doubt the most pressing topic tackled during the evening, the resounding takeaway was that attendees (and Sharesies investors alike) agree that this is no time to sit on the sidelines. Or, as James put it, “In reality, we don’t know anything about the future, so just get started. It's getting in there and learning that can help increase your confidence around investing.”

Wrapping up

Thanks so much to those who came along. The purpose of Share Club is to help connect Sharesies investors and create a space for open money discussions.

While this is only our second event, we have many more to come! If you’d like to be at our next event in your local city, keep an eye on your emails—our investors get first dibs on tickets.

We’d love to see you there.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

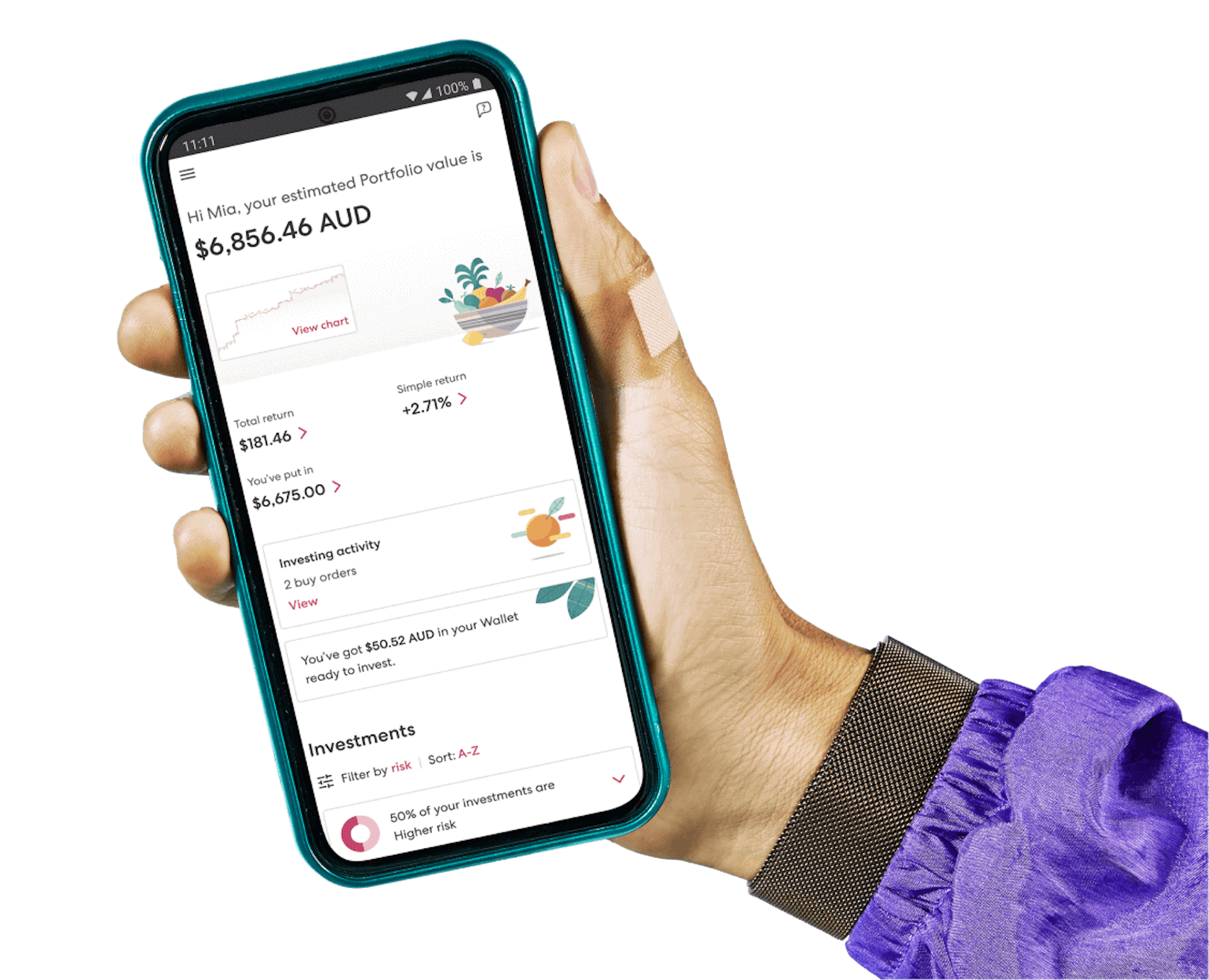

Join over 600,000 investors