2022 investing trends, tips, and tricks

Following our Share Clubs in Sydney and Melbourne, we headed to Brisbane to chat about all things money and investing.

For our first Share Club in Brisbane, our very own Brendan Doggett (Country Manager of Sharesies Australia) was joined on the panel by Elizabeth Moran (Director of the Australian Investors Association) and Whitney Meldrum-Hanna (Head of Web3 Commercial at Pedestrian Group).

Investing trends and insights

Whitney kicked off the night by sharing some key insights from Pedestrian Group’s research into money and investing.

Rising interest in money, saving, and investing 📈

Millennials and Gen Zs are thinking more long term and strategically about their careers, and about making their money work for them—particularly with all the uncertainty in the share market and economy.

Whitney referenced the COVID-19 lockdowns, and how “people at the top of their careers took a break…and more people shifted towards the FIRE movement…People want stability more than anything”.

Elizabeth added that the lockdown gave people an opportunity to learn about investing and “ways to build generational wealth”. She said “There’s a groundswell on social media where people can learn and educate one another about investing from anywhere in the world. As an individual, you can feel powerless, but you can have the power to make a change.”

Sustainability 🌱

Millennials and Gen Z are not only shopping and consuming more sustainably, but they’re also seeking more ethical investments. As Whitney noted, “Where your money sleeps at night will do so much more than your day-to-day actions.”

Elizabeth added that this has been supported by an increase in the number and popularity of exchange-traded funds (ETFs): “People can invest with their values into ETFs—they can be picky and find what suits them, due to the volume of ETFs that are now being produced.”

Web3 🕸️

Pedestrian’s research shows that 20% of respondents invest in Web3, and 70% are interested in Web3.

Whitney shared the example of Coachella creating NFTs of their tickets, which gave buyers lifetime access to the music and arts festival: “[Web3] enables something like Coachella to be an investable asset as a cultural institution, where fans can be part of the phenomenon…own a piece of culture.”

Choosing what to invest in

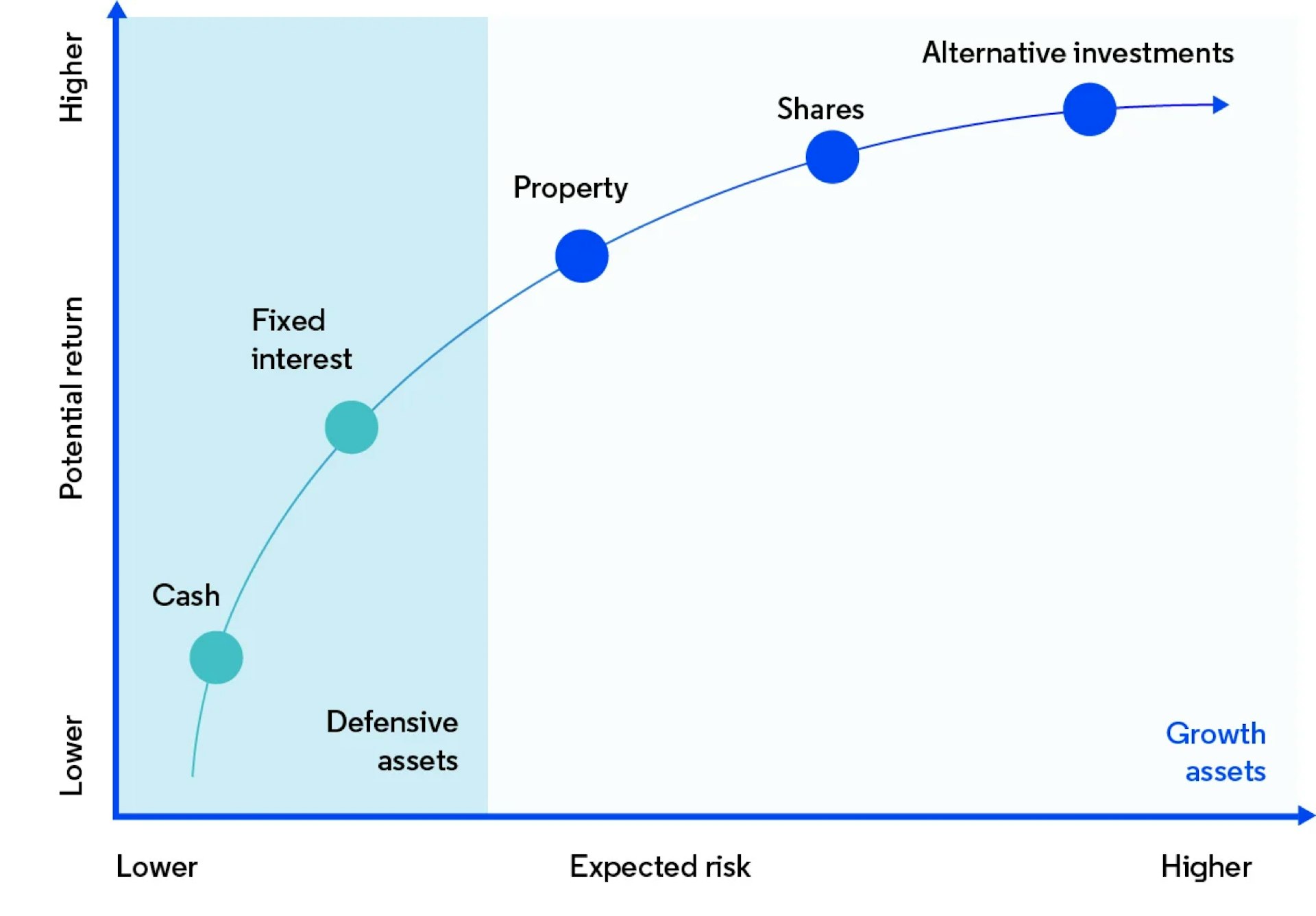

Elizabeth gave an overview of the different types of investments that are available, and how the risk and return across these options can vary.

When you’re choosing what to invest in, Elizabeth said to start by thinking about your goals, investment horizon (when you’re going to need the money), and how that matches up against the different levels of risk and reward.

Brendan noted that it’s also important to have an emergency savings account, check your superannuation fund is performing, and work out a budget—“and then work out how much money you won’t need in the next 5-10 years that you can invest…Brendan mentioned that most investors on Sharesies invest in 3 ETFs and around 2 companies.”

Tips and tricks for investors

The panel chatted about what they wish they’d known about investing when they first started.

Investing for the long term

Brendan said that when he was younger, he wish he’d known that investing isn’t the same as trading—he says investing is about building a “long-term habit”.

Whitney explained that one way she stays focused on her long-term goals is by writing down a thesis statement for an investment, and then checking back on it later to see if it still rings true: “[Social media and notifications] can create quick emotional responses and action. I write everything down. Does this update on the business I’m investing in make sense? Do these changes matter to my portfolio if I’m investing for the long term?”

Knowing when to sell an investment

Elizabeth talked about how to know when to sell an investment, and the risks of holding on to an investment for too long: “You don’t have to hold onto an investment forever. If you’ve got the right education and information, feel confident in what’s happening, and are ready to sell, don’t feel the need to stay.”

Brendan added, “Think about what you’re investing in. If you believe the company is delivering on what they say, then you might want to hold. If you think it’s going to get worse, then it’s okay to let go—but make sure to consider your circumstances, strategy, and goals.”

Keeping your cool in a market dip

Finally, Brendan talked about the ongoing volatility in the share market, and how investors are responding to it. He explained that while it can be uncomfortable seeing your portfolio “in the red”, it’s a normal part of investing over the long term—historically, markets have tended to go up over time.

He added that dollar-cost averaging is one way to average out the ups and downs of an investment over time: “No one knows what’s going to happen in the future. An investment could lose value and never recover, or it could go back up again.”

Wrapping up

Thanks a bunch to everyone who came along! From celebrating US shares on auto-invest, to hearing from our panel of experts, to connecting with like-minded investors over some Sharesies donuts—we had a blast meeting you all.

The purpose of Share Club is to help build a community of Sharesies investors and create a space for open money discussions. If you’d like to be at our next event in your local city, keep an eye on your emails—our investors get first dibs on tickets.

We’d love to see you there.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 600,000 investors